Paying bills online has become a convenient part of daily life, allowing users to settle utility payments, recharge services, and manage subscriptions from the comfort of their homes. An online bill payments app simplifies this entire process by offering all services under one roof. Users no longer need to wait in queues or visit multiple websites. With just a few taps, essential payments are completed within seconds. This level of ease is transforming how people handle their monthly finances.

Security is one of the major concerns when it comes to online transactions. Most bill payment apps come with multi-layer security features like biometric authentication, OTP verification, and encrypted payment gateways. These technologies ensure that personal data and bank details remain protected. Users feel more confident using such apps when they know their information is secure. Trust plays a major role in the continued use of digital payment platforms.

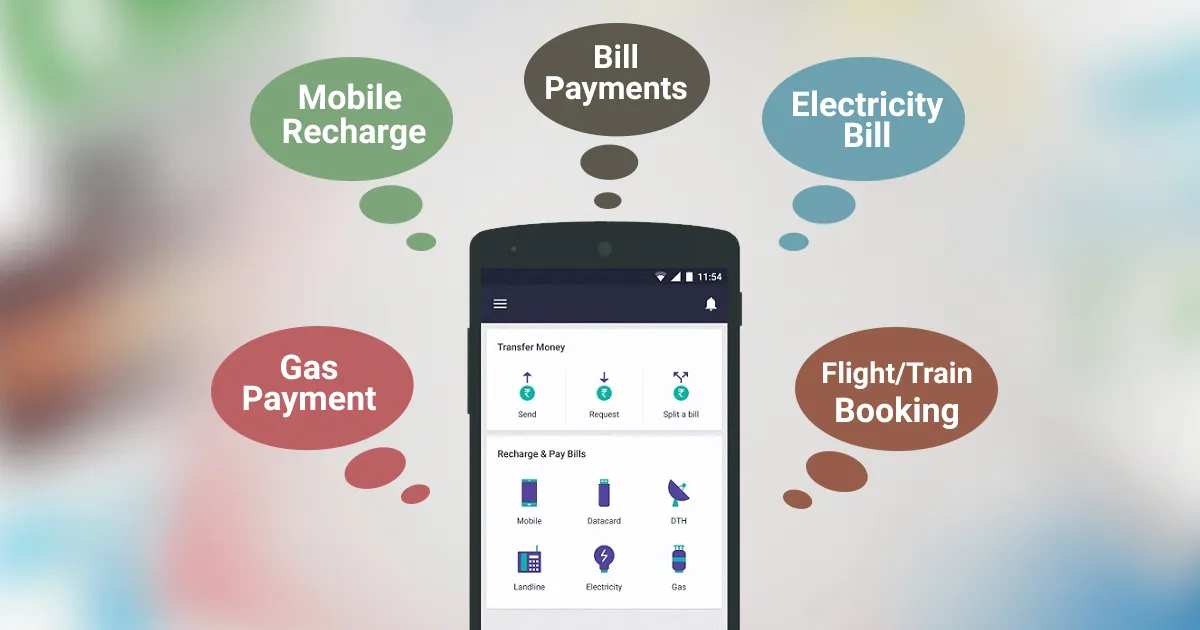

The user interface of a good bill payments app is designed to be intuitive and user-friendly. Even people who are not tech-savvy can navigate through the app and pay their bills easily. Minimal steps, clear instructions, and visual icons help guide the user smoothly. This is especially important in a country with diverse digital literacy levels. The goal is to make bill payments stress-free and accessible for everyone.

Time-saving is another key advantage of using an online bill payments app. Instead of remembering due dates for different services, users can get reminders and schedule automatic payments. This reduces the chances of missing deadlines and paying late fees. It also helps users maintain a better credit score and build a more organized financial routine. The app essentially becomes a personal assistant for bill management.

Most apps support payments for electricity, water, gas, mobile recharges, broadband, DTH, and even insurance premiums. This wide range of services means that users don’t need multiple platforms. Everything is integrated into a single dashboard, making financial tracking much easier. With past transaction records stored digitally, users can also check previous payments instantly. This level of convenience is hard to match with traditional methods.

Rewards and cashback offers have become an added benefit of using online bill payment apps. Many apps tie up with service providers or banks to offer discounts and loyalty points. This creates a win-win situation for both the app and the user. It encourages regular usage and gives users small financial perks. In the long run, this also builds customer loyalty and app popularity.

Online bill payments also contribute to reducing the use of paper, receipts, and physical bills. This makes the process more eco-friendly and supports the shift toward a digital economy. With everything going digital, users receive instant receipts and confirmation messages. There’s no worry of losing important papers or forgetting payment history. It adds to both sustainability and efficiency.

Many apps now allow linking of multiple bank accounts and UPI IDs for flexible payment options. Users can choose how they want to pay and switch between wallets, debit cards, or net banking. This flexibility ensures smooth transactions even if one payment method fails. It reflects the modern user's demand for personalization and control. Financial freedom is truly at their fingertips.

The rise of online bill payment apps is also supporting financial inclusion across rural and semi-urban areas. With smartphone access growing, even small towns are benefiting from digital bill services. This reduces dependency on agents and brings transparency to payment processes. It empowers individuals to take charge of their finances. Technology is playing a vital role in bridging the urban-rural gap.

As the digital landscape continues to evolve, bill payment apps are constantly upgrading features. From AI-based suggestions to voice command payments, innovation is shaping the future of financial transactions. These apps are not just tools for paying bills but have become part of daily life. They reflect the fast-paced, connected world we live in today. The future of bill payments is digital, seamless, and smart.

Customer support plays a vital role in the overall user experience of any online bill payments app. Most apps now provide 24/7 customer service through chat, email, or phone. This ensures that users can get help immediately if a payment fails or an issue arises. Quick resolution builds user trust and satisfaction. A reliable support system strengthens the app’s credibility.

With more people using digital payments, data analytics is being used to understand user behavior. Apps now offer personalized suggestions based on spending patterns and bill types. For instance, users may get notified about upcoming bills they usually pay around a certain date. These intelligent features make financial planning easier. It’s like having a smart reminder system built into the app.

Offline access and low-data modes are being introduced in some apps to serve users with limited internet connectivity. This is especially useful in rural areas or during network outages. It allows basic functions like viewing due bills or generating QR codes for payment. These thoughtful features make the app usable in more real-world situations. Accessibility becomes a strong advantage.

One major benefit for businesses and service providers is the faster processing of payments. With real-time confirmation, companies can update records quickly and provide uninterrupted services. This also improves transparency and reduces the chances of billing disputes. Businesses save time and operational costs by going digital. It’s a positive step for both providers and customers.

Educational campaigns and digital awareness programs are helping more people understand how to use these apps safely. Financial literacy is growing as users become more confident in managing bills through their phones. Governments and fintech companies are working together to promote this adoption. It’s creating a more informed and digitally empowered population. The digital divide is slowly shrinking.

Integration with government portals and public utility systems is another growing trend. Users can now pay taxes, traffic challans, and government fees through these apps. This reduces bureaucracy and paperwork while improving transparency. The system becomes faster and less prone to errors. Digital governance is becoming more efficient with such tools.

Online bill payments apps are also becoming a platform for other financial services. Many now offer credit card payments, mutual fund investments, and insurance renewals. Users can manage a range of financial tasks from one app. It turns into a mini-financial hub for the average user. This multifunctionality adds great value and saves time.

Language support is an important factor in making these apps user-friendly across different regions. Most apps now offer multiple regional languages to suit local preferences. This inclusion makes users feel more comfortable and increases app adoption. Language should never be a barrier to technology. Developers are focusing on localization for wider reach.

User reviews and app ratings are useful for new users to understand the quality and trustworthiness of a bill payments app. High ratings and positive feedback often reflect a reliable and smooth experience. People rely on the experiences of others before downloading or using a new platform. Transparency and honesty in user feedback help apps grow and improve.

Finally, the future of online bill payments will likely include AI chatbots, voice assistants, and even wearable integrations. Imagine paying your electricity bill with a simple voice command to your smartwatch. These innovations will continue to make the process faster and more natural. As technology evolves, so will the ways we interact with money. The journey of digital bill payments is just getting started.